Established on 30th November 1999, Uttar Pradesh Power Corporation Ltd. (UPPCL) is a government managed organization engaged in the management of effective supply of electricity to every citizen in the state.

A host of responsibilities in the organization is managed by the highly efficient team members, vendors, and state of art technologies aimed at rendering decent return to our investors on their investments. We aim at emerging as dependable and professional service provides in the state.

UPPCL has witnessed consistent growth and have helped stake holders and other investors earn returns on their investments. We are a secure company and are constantly working for the organizational growth. The Uttar Pradesh Power Corporation Ltd. is a stable organization assuring relatively higher returns on your investment in UPPCL NCDs. Investing in UPPCL NCDs can be a suitable choice for both the type of investors, retail, and institutional investors.

It is known to offer good return on investment. Your investment in the UPPCL NCDs can help you diversify your portfolio and enjoy the advantage of risk-reward.

Why Choose UPPCL Bonds to Invest

The UPPCL October 2022 Issue can be surely considered by the investors for long-term investment. The coupon rate offered is also relatively higher. Investing in UPPCL is free from hassle.

The issued bond is backed by the stage government and is safe for the investment purpose. You have minimal to no risk on your capital. The higher credit rating makes it more secure and dependable.

Latest Bonds

Latest Bonds

Latest IPOs

Issuer

Issue Size

Coupon

Open Date

Latest IPOs

Why IPOs/Bonds or NCDs are issued?

Every organization and entity have one or more purpose behind issuing IPOs/Bonds or NCDs. The key purpose of bonds issue is fund raising to fund projects, business operations, and fulfil varied company objectives. Also, raising funds through bonds, NCDs or IPOs are cheaper than bank loans. UPPCL bonds have earned good credit ratings. It is known to offer better interest income to the UPPCL bondholders in India.

Why Should You Invest?

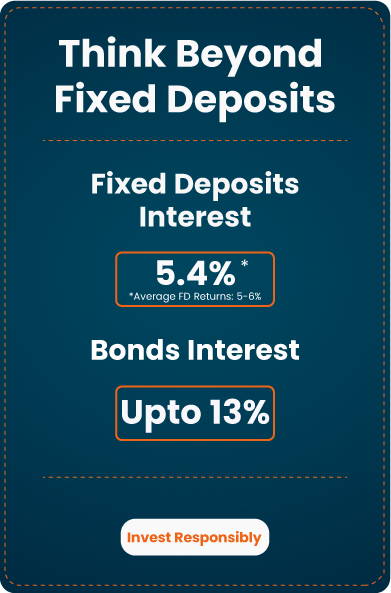

Investing in bonds or IPOs brings to you a host of benefits. You get a fixed interest on your investment. The return can be expected periodically or accumulated return at maturity. Moreover, your investment in long-term and short-term investing options can help you accomplish your different financial goals in your life. Investing in UPPCL NCDs can help you live your different financial dreams. Since the UPPCL NCDs are backed by government, you have the minimum risk of monetary loss. The risk of capital loss and interest is comparatively low.

Financial Highlights

How to Buy Bonds at BondsIndia?

The expert team at BondsIndia has ensured fast navigation and distinctive user experience. You need to visit BondsIndia.com, create your account or log in using your existing credentials, choose the bonds from the available listed corporate bonds or other type of bonds for trade, and initiate the payment securely.

Why Choose BondsIndia?

Advantages With UPPCL

Investing is a good habit but investing in the right company is more important. UPPCL is known to be one of the best and safe option to park your surplus money. A few years back people awaited UPPCL IPOs eagerly. The wait surprised them with good returns, stable income, and assurance of capital protection.

- A secure option to invest your money

- Higher return and a source for fixed income

- The best choice for long-term investment plans

- Minimal risk as it has higher credit ratings

- Less risk of capital loss

- UPPCL Bonds are backed by the state government of Uttar Pradesh

Frequently Asked Questions

Yes, you should buy UPPCL bonds as it is known to offer better returns.

UPPCL has higher ratings due to it good credit worthiness in the market. The higher ratings make UPPCL a safe bond to invest.

Uttar Pradesh Power Corporation Ltd. (UPPCL) bonds are preferred for its higher interest and minimal risk of capital loss.

You can visit us or follow BondsIndia for the information on upcoming bonds, IPOs, or NCDs along with the information about ongoing investment options online.

BondsIndia using the technical integration and team of professionals have ensured secure trade in bonds.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.