Piramal Capital & Housing Finance Limited (PCHFL) is a renowned company engaged in the business of housing finance. It majorly deals in rendering financial assistance in wholesale and retail to businesses in the real estate and non-real estate sectors. The company within the real estate sector is known to provide a diverse range of solutions to your financial needs. It includes debt instruments, private equity, housing finance, and Flexi lease. The satisfactory creditworthiness has kept Piramal bond price competitive in comparison to other companies issuing non-convertible debentures.

Piramal Capital & Housing Finance Limited, founded in the year 2017, is a wholly-owned subsidiary of Piramal Enterprise Limited. It has its registered office in Mumbai. Piramal Capital & Housing Finance Limited issues Piramal NCD bonds from time to time with different objectives.

You can choose to buy Piramal NCD bonds considering your investment needs and your risk-taking appetite. For a better decision, you can consider the credit rating allocated to the company.

Why Choose Piramal NCD Bonds to Invest?

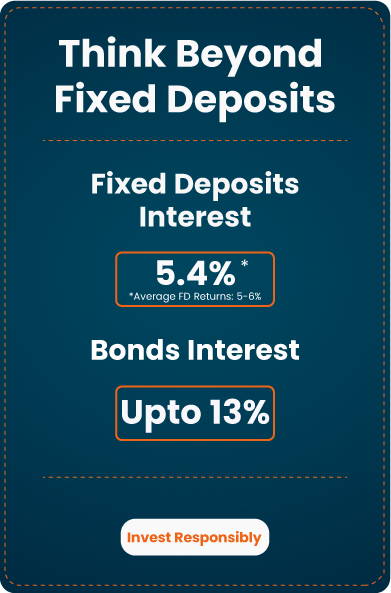

Investors prefer to buy Piramal Capital & Housing Finance Limited bonds. Company bonds are known to perform well in the market. The Piramal NCD coupon rates generally range between 8% to 9%, and sometimes more. The issued NCDs can be secured, senior, listed, and redeemable NCDs. These Non-convertible debentures (NCDs) are sometimes issued in different series. The tenor of the NCDs varies from series to series. However, the tenor ranges between 26 months to 120 months.

The company offered coupon rate is attractive and good for investors who are prepared to take some risk. The returns earned can help you accomplish your varied financial goals. You can think over your decision of Piramal secured bonds buy online as it may prove to be a fruitful decision.

Latest Bonds

Latest Bonds

Latest IPOs

Issuer

Issue Size

Coupon

Open Date

Latest IPOs

About PCHFL NCDs July 12-23, 2021

The below details are about the PCHFL’s July 2021 NCDs issued before the acquisition of Dewan Housing Finance Ltd. (DHFL). Investors have shown keen interest in the issue. You can visit this dedicated page designed for Piramal Capital & Housing Finance Limited for updated information about upcoming issues, bonds, or IPOs for a potential investment opportunity.

| Issue Open | Jul 12, 2021 - Jul 19, 2021 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Security Name | Piramal Capital & Housing Finance Limited | ||||||||

| Issue Size (Base) | Rs. 200.00 Crores | ||||||||

| Issue Size (Shelf) | Rs. 800.00 Crores | ||||||||

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) | ||||||||

| Issue Price | Rs. 1000 per NCD | ||||||||

| Face Value | Rs. 1000 each NCD | ||||||||

| Minimum Lot Size | 10 NCD | ||||||||

| Market Lot | 10 NCD | ||||||||

| Credit Rating | CARE AA, ICRA AA with outlook (Negative) | ||||||||

| Tenor | 26, 36, 60, and 120 months | ||||||||

| Listing At | BSE, NSE | ||||||||

| Basis of Allotment | First Come First Serve Basis |

You can take into consideration the above information to plan your investments. The more information you have, the better may be your decision related to investing in THDC India Limited NCD IPOs.

More About Piramal Capital & Housing Finance Limited (PCHFL)

Piramal Capital & Housing Finance Limited (PCHFL) had a net non-performing asset (NPAs) of 1.90% and a loan book of ₹32,354 crores as of March 31, 2021. This loan book constitutes 3/4th of loans to Real estate, 7.1% to non-real estate corporate finance, and 13.7% retail lending.

PCHFL between FY19 and FY21, reported a 15.3% decline in net profit amounting to Rs. 1034 crore and a 4 percent downfall in operating income to Rs. 5,082 crores. and 15.3 percent decline in net profit to ₹1,034 crores. DHFL s of March 31, 2020, had a loan book of Rs. 66,203 crores and Rs. 5538 crores negative net worth. In Sept 2021, Piramal Capital & Housing Finance Limited became one of the largest country’s housing finance companies post acquiring Dewan Housing Finance Ltd. (DHFL).

FINANCIAL HIGHLIGHTS

THDC INDIA LIMITED Amount in CR

| YEARS | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| TOTAL ASSETS | 79,63.963 | 52,65,668 | 50,78,770 | 52,12,248 | 4,472,708 |

| REVENUE | 6,18,692 | 5,08,790 | 5,62,261 | 55,7,186 | 4,623 |

| PROFIT | 52575 | 103444 | 3048 | 144258 | -3187 |

| Total Assets | Debt- Equity ratio | Net worth | Net profit margin |

|---|---|---|---|

| 79,63.963 | 2.09 | 11,93,345 | 8.50% |

How to Buy Bonds at BondsIndia?

If you are new to bonds and looking for a secure and hassle source to buy bonds in India, BondsIndia can be the right choice. It can help you save time and enjoy a good buying experience. If you are worried thinking about how to buy Piramal secured bonds, stop worrying. You can explore types of Bonds, reports, product ranges, and available bonds for trade, and commence your investing journey in minutes at BondsIndia.

You can visit BondsIndia and register in a few simple steps. After your KYC, you are ready to start investing in bonds.

Piramal Capital & Housing Finance Limited – Key takeaways

1. Piramal Capital & Housing Finance Limited was earlier popular as Dewan Housing Finance Corporation Ltd.

2. Today the company is referred to as Piramal Finance

3. The 15th Annual Euromoney Real Estate Survey 2019 recognised Piramal Finance as India’s ‘Best Overall Investment Manager’

4. Earner ranked 13th amongst ‘Asia’s 25 Best Workplaces 2019’

5. Recognised as ‘The Best Debt provider of the Year – Alternative’ amidst global private equity space at the Private Equity Wire Awards 2019

Advantages

Piramal Capital & Housing Finance Limited (PCHFL) unlike other service providers is known to offer a product range to customers in the financial segment. Piramal-secured bonds can provide competitive returns on your investment because of their performances in the market and trust among investors.

What Makes Piramal Capital & Housing Finance a Good Buy?

- The Company has become one of the largest housing finance companies in India post completing the successful acquisition of Dewan Housing Finance Ltd. (DHFL) in Sep-2021

- The company as of March 31, 2022, had an AUM of Rs. 65,185 Crores

- The Company has a stake in Pramerica Life Insurance which is 50% – a joint venture with Prudential International Insurance Holdings.

- Potential of a better return on investment in Piramal secured bonds

- Low risks and liquidity feature

Piramal Capital & Housing Finance Limited (PCHFL) is known to be a company you may trust for your investments. You can choose to buy Piramal secured bonds online at BondsIndia once it is available for investment.

Piramal housing finance rate of interest can be an attraction for you. If you wish to buy Piramal NCD bonds, consider gathering the essential information. The company facilitates Piramal secured bonds buying online can be helpful for retail investors. It will help you take the right decisions related to investments.

Frequently Asked Questions

Piramal Capital & Housing Finance Limited is known to provide a competitive return on your investment.

You can check the credit rating provided by the rating companies to check the creditworthiness of the issuer.

It is better to check the current financial status, coupon rate, and credit rating of the issuer before investing in NCDs.

Bidding for Piramal can be a good decision subject to your need for investment.

Yes, you can generate the request for a quote (RFQ) at BondsIndia to buy a bond not available with BondsIndia.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.