Hinduja Leyland Finance (HLF) is an NBFC based out of Chennai, Tamil Nadu. It is a non-deposit accepting systemically important (ND-SI) non-banking financial company belonging to the Hinduja Group. Established in 1918 in Mumbai, the Hinduja Group has a global presence and is spread across 30 nations. HLF is the subsidiary of Ashok Leyland Limited (ALL, rated ‘CARE AA; Negative/ CARE A1+’), one of the leading players in the domestic commercial vehicle segment.

The group has a presence in various industries, including automotive, banking & finance, information technology (IT)/ information technology-enabled services (ITES), and energy & chemicals. HLF is a strategically important subsidiary for ALL (Ashok Leyland Limited), and ALL vehicles constitute 34% of HLF’s AUM as on March 31, 2021. Being part of the Hinduja Group, HLF enjoys significant financial flexibility in terms of mobilising funds from various sources at competitive rates.

The company HLF laid its foundation in 2008. It commenced its operations including lending in FY11 after RBI license receipt in March 2010. The group’s flagship automobile manufacturing company, Ashok Leyland Ltd. promoted the company Hinduja Leyland Finance with the objective to provide the necessary funding support to ALL vehicles. Hinduja Leyland Finance Limited IPO has been doing well and is one of the preferred.

Why Choose Hinduja Leyland Finance Limited NCD IPOs to Invest?

Hinduja Leyland Finance Limited in the last few years seems to have earned a good reputation in the markets and has become one of the preferred service providers for vehicle loans. The company during FY21, reported a PAT (Profit Before Tax) of Rs.270 crore (PY: Rs.292 crore) on a total income of Rs.2,775 crore (PY: Rs.2,927 crore). HLF from 41.11% as on March 31, 2020, increased its provision coverage to 51.38% as on March 31, 2021. The Management overlay stood at Rs.110 crore as on March 31, 2021.

HLF as on December 31, 2021, restructured its portfolio amounting to Rs.1,660 crore (6.42% of AUM). The provision coverage ratio of repossessed assets as of March 31, 2021, also increased to 43.19% (PY: 35.37%). You can check about Hinduja Leyland Finance Limited IPO online for investments.

Latest Bonds

Latest Bonds

Latest IPOs

Issuer

Issue Size

Coupon

Open Date

Latest IPOs

What type of loans does Hinduja Leyland Finance offer?

Hinduja Leyland Finance is a reputed company based in India. It is engaged in catering to the need for finance of customers in different categories, particularly for vehicles.

Hinduja Leyland Finance (HLF) in India offers vehicle loans to buy -

➢ Small commercial vehicles (SCVs)

➢ Three-wheelers

➢ Two-wheelers

➢ Light commercial vehicles (LCV)

➢ Tractors, etc.

Transport companies or individuals looking to buy commercial vehicles on finance can seek vehicle loans from Hinduja Leyland Finance at a competitive rate of interest. For details on eligibility, documents required, and other terms, you can contact the company representative anytime.

What other loans does Hinduja Leyland Finance (HLF) provide?

Hinduja Leyland Finance is also known for its financial product range. You can have a look at its exclusive product range apart from vehicle loans.

Hinduja Leyland Finance (HLF) in India also provides

➢ Loan Against Property (LAP)

➢ Construction Equipment

➢ Used Commercial vehicles financing

No matter whether you need to apply to seek a loan against property, a loan for construction equipment, or need finance for used commercial vehicles, you may consider Hinduja Leyland Finance for the same.

FINANCIAL HIGHLIGHTS

HINDUJA LEYLAND FINANCE LIMITED Amount in Lakhs

| YEARS | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| TOTAL ASSETS | 20,96,127 | 21,92,262 | 20,76,062 | 20,20,069 | 1,550,243.91 |

| REVENUE | 2,66,046 | 2,77,482 | 2,92,748 | 2,56,064 | 195,936.30 |

| PROFIT | 23,215 | 27,013 | 29,197 | 27,564 | 18,983.62 |

| Total Assets | Debt- Equity ratio | ROE ratio |

|---|---|---|

| 20,96,127 | 4.02 | 18.43% |

How to check Hinduja Leyland Finance Limited IPO date?

Investing in IPOs or NCDs is a big decision. It is necessary to have authentic information about the investment instruments. You can explore BondsIndia or visit the HLFL website for information and update on Hinduja Leyland Finance Limited IPO dates. You can also visit the company website for relevant details and update on bonds, IPOs, etc.

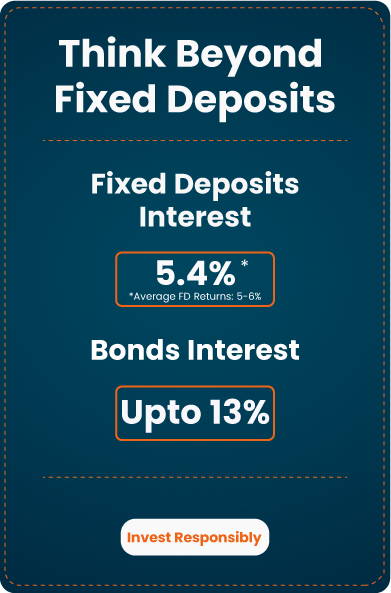

Why Choose BondsIndia to invest in Bonds?

The company gives you multiple reasons to choose the online platform. You would certainly feel the difference.

You can have a look at a few advantages listed below:

Do not waste your time and fall prey to the unprofessional. Instead, visit BondsIndia for an unforgettable investing experience.

Advantages

According to the reports online, as on December 31, 2021, the shareholding of the Hinduja Group in HLF stands at 99.4% wherein Ashok Leyland Limited holds a 68.8% stake. You may enjoy the following benefits by choosing Hinduja Leyland Finance Limited NCD IPOs for secure investing.

Advantages to Investors With Hinduja Leyland Finance Limited

- A stable company with countrywide penetration

- The company has the advantage of the group

- The company has a countrywide presence and operates in the major cities

- HLF today has a good number of customers

- The wide range of target audiences helps increase business

- The Hinduja Leyland Finance Limited NCD IPO can help investors earn good ROI

Hinduja Leyland Finance thus is a company people trust for their committed services. You may consider it a one-stop destination for loans of different types.

Frequently Asked Questions

Online platforms like BondsIndia.com can help you gather information about the HLF IPOs or NCDs or Bonds.

Since the company has the advantage of group company advantage, the growth rate of good. You may expect a better return on your investment in Hinduja Leyland Finance Limited NCD IPOs.

It is better you consider the creditworthiness and credit rating allocated to an issuer prior to your decision of investing or buying Hinduja Leyland Finance Limited NCDs.

BondsIndia of course is a secure investment platform online. You can easily invest or sell bonds online anytime. Investing in bonds is a distinctive experience at BondsIndia.

You can check online or visit the company-dedicated website for the Hinduja Leyland Finance Limited IPO date.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.