Promoted by the Edelweiss Group ECL Finance is a leading NBFC

in India. The company is engaged in rendering a diverse range

of retail and corporate credit products including corporate

finance, loan against property, loan against marketable

securities, real estate finance, public issue financing, SME

finance, and structured finance. ECL Finance Ltd is known to

do good in the market in comparison to many other competitive

companies.

ECL Finance has a diversified business model. The working

model and services reflect their expertise in catering to the

different financial needs of the common citizen in urban and

rural households along with companies in large and small

categories. The Edelweiss Group is listed on the National

Stock Exchange (NSE) and Bombay Stock Exchange (BSE). It not

only has a pan-India presence but also serves clients based

abroad. The company has offices in Dubai, New York, Mauritius,

Hong Kong, Singapore, and the UK. People waiting for the

Edelweiss NCD 2022 can explore BondsIndia and rush to invest

with a secure issuer in the country.

You can explore BondsIndia to learn about Edelweiss NCD IPOs

and other attractive options to invest in. The investment

might help you meet your varied investment needs.

Why Choose ECL Finance Ltd for the Investment?

People worldwide are found exploring ECL Finance Ltd's share price and the opportunities to invest in the company. The company recently issued bonds to allow retail investors to buy and commence with the investment in ECL Finance.

The success of the company is also evident through its recent issue that has received a good response. ECL Finance Limited bond bearing ISIN INE804I079Y6 (06-Aug-2018) has offered the secured bond coupon rate of 9.85% having a face value of Rs. 1000 each. The leading rating agency CRISIL has allocated it the rating AA/Negative and the maturity date for it is 6th Aug 2028. The company succeeded in winning the trust of investors. ECL Finance Ltd share price may attract investors also from the retail segment.

ECL Finance Limited (ECLFL) being part of the Edelweiss Group, a prominent financial services organization in India has won the trust of investors also from the retail segment. Your decision to bid for ECL Finance Ltd debentures can prove a good decision.

Latest Bonds

Latest Bonds

Latest IPOs

Issuer

Issue Size

Coupon

Open Date

Latest IPOs

What are the product ranges in the corporate and retail credit segment?

There are many reasons that make the company stand out in the crowd. ECL Finance Limited is a growing and highly sought company online. The company is known to facilitate a wide variety of product ranges in the corporate and retail credit segment to its valued customers based at varied locations.

Below are the popular product ranges in the corporate and

retail credit segments:

ECL Finance Products Offerings

The company is popular among investors and customers because of several reasons. The below-mentioned company's corporate credit offerings are also a considerable factor for many investors.

Corporate Credit

The company is popular among investors and customers because of several reasons. The below-mentioned company's corporate credit offerings are also a considerable factor for many investors.

➢ Structured collateralised credit

➢ Mid-corporate lending

➢ Wholesale mortgage

Individuals or companies interested in any of the corporate credit products can browse the company's website for detailed information.

Retail Credit

Retail credit products can be another key attraction for a few other borrowers and investors. You can have a look at the below popular retail credit products.

➢ SME & business loans

➢ Loan against property (LAP)

Users/customers can take limitless advantage of the company's useful products classified in the corporate & retail credit segments. You can explore online to learn about the eligibility, documentation, and other conditions applicable to different loan types.

Why Should You Invest in ECL Finance Instruments?

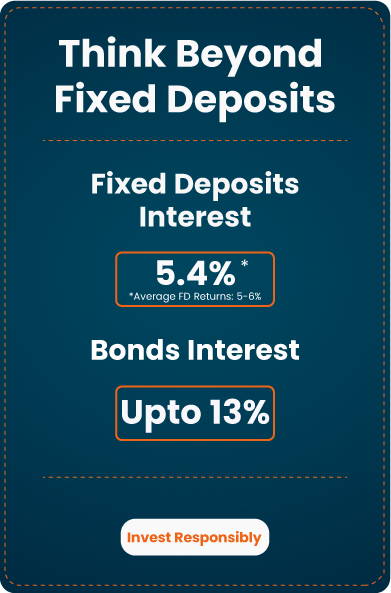

Many reasons motivate you to invest in one or more

ECL Finance instruments. The NCD, IPOs, bonds, and

other stocks may help you opt for monthly, annual, or

cumulative interest income. ECL Finance NCDs are known to

offer coupon rates ranging from 8% to 9.70%. The closing

price of ECL Finance shares 925EFL23 was Rs. 970.5

as of 26-Dec-2022. If we talk about its 52-week high and

low, it was Rs. 1,195 and Rs. 898.1 respectively.

Make an informed investment decision after analysis of the

company’s stocks.

ECL FINANCIAL HIGHLIGHTS

ECL FINANCE LIMITED Amount in Million

| YEARS | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| TOTAL ASSETS | 1,43,459.89 | 1,89,790.72 | 2,33,627.91 | 2,74,645.89 | 2,63,703.88 |

| REVENUE | 16,607.69 | 20,120.44 | 36,176.53 | 40,174.58 | 32,723.48 |

| PROFIT | 793.53 | 22.35 | -14,144.59 | 5,658.83 | 4,705.35 |

| Total Assets | Debt- Equity ratio | ROE ratio | Return on Assets |

|---|---|---|---|

| 1,43,459.89 | 2.95 | 3.15 | 0.48 |

What Distinguishes BondsIndia?

BondsIndia is a highly sought online platform serving retail investors. Promoted by Launchpad Fintech Pvt. Ltd, the platform distinguishes itself from others in many terms.

The following are a few considerable distinguishing factors:

For more information on products, services, and other facilities, you can visit the website anytime.

Advantages

ECL Finance is known to offer products suitable for corporates and retail individuals. The company bonds are known to do good in the market and can be ideal even for retail investors in India.

Advantages to Investors with ECL Finance

- Investors at ECL Finance Limited NCDs have the option to choose from 24 months, 36 months, 60 months, & 120 months

- You have the option to opt for cumulative interest payment, monthly or annually

- ECL Finance NCDs Coupon rates generally range from 8.50% - 9.70% annually. You can choose to buy considering your investing needs.

- Investors can expect a relatively better annual yield of not less than 8% annually because the company has already offered 9.85% in 2018.

As an investor, if you compare their Convertible Debentures, you will find that ECL Finance Ltd provides better yields and liquidity. The risk is also minimal. You also get the benefit of tax advantages to the investors.

If you wish to take advantage of Separate Trading of Registered Principal Parts (STRPP), National Highway Infra Trust (NHIT) NCDs can be a good option. The NHIT’s NCD of Rs. 1000 each is divided into 3 STRPPS of 300, 300, and 400 each for investors.

Frequently Asked Questions

Structured collateralised credit, Mid - corporate lending, and Wholesale mortgage are the product offerings included in the ECL Finance Corporate Credit.

SME & business loans and Loans against property (LAP) are the popular product offerings included in the ECL Finance Retail Credit.

You can browse BondsIndia and ECL Finance anytime to buy ECL Finance Ltd bonds.

The choice of investing in ECL Finance Ltd debentures lies with you. However, it is better to gather relevant information about the offering and the company before payment.

BondsIndia is a tech-enabled online platform that aims at simplifying bonds. Moreover, navigation, maintaining the portfolio, and KYC at BondsIndia are hassle-free.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

*

Investments in debt securities are subject to risks. Read all

the offer related documents carefully.

N/A stands for Not Applicable

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.