Bharat Petroleum Corporation Limited is a renowned organisation based in India. It is a leading company in the Oil & Gas sector. It is popular among masses by the brand name BPCL. The company BPCL is engaged in the exploration and production of petroleum & petrol-related products. The company is also engaged in retailing petroleum products and petrol-based products including marketing of petrol, diesel, and kerosene.

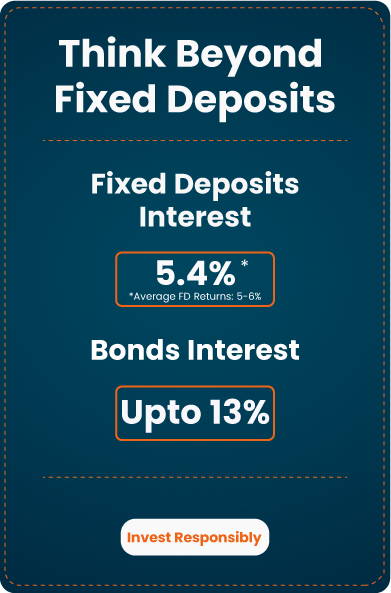

The company to fulfill its different objectives from time-to-time issues Non-Convertible Debentures (NCDs) at a coupon rate payable annually. The coupon rate varies based on certain factors. Hence, investors looking to buy Bharat Petroleum Corporation Limited NCD IPO should gather relevant and authentic information before placing the bid for the announced issue.

The company in the past raised Rs. 1,000 crores at a coupon of 8.02% per annum. It was through private placement of unsecured NCDs (Non-Convertible Debentures) payable annually with a door-to-door maturity of 5 years on March 11, 2019. The proceeds were to be used for funding the Capital Expenditure of the Company. The retail business unit of BPCL is into the marketing of kerosene, petrol, and diesel. Investing in Bharat Petroleum Corporation Limited IPO can be an ideal choice for an investor.

Why Choose Bharat Petroleum Corporation Limited NCD IPO to Invest?

The company Bharat Petroleum Corporation Limited gives you many considerable reasons to invest in its issues. Many investors have been reaping the fruit of the decision related to investing in Bharat Petroleum Corporation Limited NCD IPOs. Bharat Petroleum Corporation Limited's share price has constantly increased due to its performance in the competitive market.

Bharat Petroleum on a trailing 12-month basis has an operating revenue of Rs. 435,308.08 Crores. There is 50% outstanding annual revenue growth where 4% pre-tax margin though needs improvement, 22% ROE is exceptional. The stocks overall have mediocre earnings & technical strength. In the current market environment, there are superior stocks. BPCL in India is the second-largest oil corporation owned by the government of India.

Latest Bonds

Latest Bonds

Latest IPOs

Issuer

Issue Size

Coupon

Open Date

Latest IPOs

Where in India are the BPCL refineries?

Bharat Petroleum Corporation Limited (BPCL) in India operates three refineries at different locations. The everyday production capacity of each refinery varies from one another.

The BPCL refineries are located at the following three locations:

Refineries play an important role in the petroleum sector. Hence, Bharat Petroleum Corporation Limited (BPCL) are found focusing on the smooth administration of each refinery.

What are the popular BPCL products?

The company Bharat Petroleum Corporation Limited (BPCL) is a well-known company. It is engaged in serving the countrypeople with multiple petroleum products.

Below listed are the popular BPCL products:

The BPCL products are known for their quality and efficiency. People in the country trust the company products and investors prefer to invest in the company.

FINANCIAL HIGHLIGHTS

BHARAT PETROLEUM CORPORATION LIMITED Amount in CR

| YEARS | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| TOTAL ASSETS | 187,528 | 160,992 | 150,863 | 136,930 | 120,356 |

| REVENUE | 349,059 | 232,415 | 286,501 | 300,263 | 237,569 |

| PROFIT | 10,145 | 17,645 | 2,265 | 7,590 | 8,503 |

| Total Assets | Debt- Equity ratio | Net worth | Net profit margin |

|---|---|---|---|

| 187,528 | 1.08 | 22.5 | 6.22 |

How to buy Bharat Petroleum Corporation Limited bonds?

You can buy or sell Bharat Petroleum Corporation Limited bonds at BondsIndia by following a few simple steps.

➢ Click https://client.bondsindia.com/signup

➢ Commence creating your account with us

➢ Fill your personal details

➢ Enter your Demat and Bank account details

➢ Complete KYC

➢ Choose the desired BONDS and payment mode

➢ Submit your Bid

You can alternatively call our Bonds Manager to assist you with your account creation on BondsIndia. Our experts will help you buy Bharat Petroleum Corporation Limited (BPCL) bonds and other company’s bonds in a few minutes.

What does BondsIndia Portfolio Page displays?

Our Portfolio Page displays the list of active bonds live for trade.

You can browse Portfolio Page to know about

➢ The bond issuing company

➢ Price of a bond

➢ Yield percentage

➢ Credit rating

➢ Maturity

Advantages

Bharat Petroleum Corporation Limited bonds are known to perform well and have earned the trust of investors. It succeeded in achieving 792nd rank on Forbes' 2021 'Global 2000' list and the 309th rank in the 2020 Fortune List of the world's biggest corporations.

Key Advantages with BPCL

- Bharat Petroleum Corporation Limited NCD IPOs are performing well in the market

- Many investors have been continued growth in Bharat Petroleum Corporation Limited share price

- The company has the revenue of INR 432,570 crore (US$ 54 billion) in 2022

- Bharat Petroleum Corporation Ltd (BPCL), the state-run oil marketing company is in the continued process of business expansion

- The company believes in being transparent to its investors

- The company is prompt in information distribution to shareholders and other investors

- Bharat Petroleum Corporation Limited IPO can prove to be a good investment choice for retail investors too considering its good creditworthiness.

Frequently Asked Questions

The Ministry of Petroleum and Natural Gas in India manages BPCL.

If you consider the recommendation of analysts, buying Bharat Petroleum Corporation Ltd (BPCL) IPOs can be a good decision. The company has Rs. 435,308.08 Crores as operating revenue and better ROE. The increase in institutional holdings in the most recent quarter is a positive sign that can be considered.

The company BPCL’s headquarters is in Mumbai, Maharashtra.

The P/E ratio as on 02 December, 2022 of Bharat Petroleum Corporation is -82.7.

Request a Call Back

Request in Process

Please enter the OTP sent to the mobile number with reference number

Select your time

Select the time slot as per

your preference

SEBI Registration No. : INZ000296636 | BSE Member ID: 6746 | NSE Member ID: 90329

All rights are reserved by Launchpad Fintech Private Limited having its brand name Bondsindia, its associates and group Companies.